Income Tax For Foreigners Working in Malaysia 2021. Form B Form B deadline.

Firs Extends The Deadline For Filing 2022 Year Of Asses Kpmg Nigeria

However if you derive income from employment then you have to file your taxes before April 30th.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KH4SZPOVAZIN7M3QJ2IU3ULAUA.jpg)

. On the First 5000. For example a company that closes its accounts on 30 June of each year is taxed on income earned during the financial year ending on 30 June 2022 for year of assessment 2022. For further information consult the dedicated page on the official website of the Inland Revenue Board of Malaysia.

Malaysia Payroll And Tax Guide Activpayroll Activpayroll. Corporate tax rates for companies resident in Malaysia is 24. Advertisement taxes are inevitable but if you are educated you can soften their impact.

September 17 2021 Post a Comment Dont miss any tax deadlines in 2021. Additional 5 increment on the balance of a if payment is not made after 60 days from the final date. Form EA Important Notes.

Declaration report of companies Form E deadline. Income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800 14 70000 4600 21 100000 10900 24 400000 83650 25. Personal income tax filing Form BE deadline.

Malaysia income tax rate 2017. Form E Important Notes. Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking. Employment income BE Form on or before 30 th April. Malaysia Sales Tax 2018.

Income tax return for partnership. Income tax return for partnerships Form P. Aside from having to pay more if youre late to submit your tax form you will get fined if you understated your taxes dont submit a form at all or for various other offences.

The most up to date rates available for resident taxpayers in Malaysia are as follows. Both residents and non-residents are taxed on income accruing in or derived from Malaysia. SST Treatment in Designated.

Foreign income remitted into Malaysia is exempted from tax. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share. There are a total of 11 different tax rates depending on your earnings so figuring out what you owe can be complicated.

Personal Relief 2018. If youre self-employed for instance then the deadline is June 30th. Business income B Form on or before 30 th June.

Calculations RM Rate TaxRM A. 1 Corporate Income Tax 11 General Information Corporate Income Tax. Income Tax Malaysia 2018 Mypf My.

Malaysia Service Tax 2018. Unlike the income tax rates for 2018 and 2017 there is virtually no change in income tax reliefs for the two assessment years. The deadline for filing income tax in Malaysia is April 30 2019 for manual filing and May 15 2019 via e-Filing.

The deadline for filing your tax return depends on where your income comes from. Income tax relief Malaysia 2018 vs 2017. For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24.

The Government has announced an extension of two months for filing income tax from the original deadline in consideration of the Movement Restriction Order MRO that has been enforced during the COVID-19 pandemic. 30042022 15052022 for e-filing 5. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the.

Malaysia Income Tax 2018 Deadline. On the First 5000 Next 15000. Malaysia has implementing territorial tax system.

In fact there is only one minor change which applies to the medical expenses and examination of the individual spouse or child. Yearly remuneration statement Form EA Deadline. Tax relief refers to a reduction in the amount of tax an individual or company has to pay.

As the first deadline to file your income tax has just passed you may. Employment income e-BE on or before 15 th May. The tax filing deadline for person by 30 April in the following year.

In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018. The new deadline for filing income tax returns in Malaysia is now 30. The amount of tax relief 2018 is determined according to governments graduated scale.

Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis. Notice Regarding Extension Of Filing Deadline For Labuan Corporate Tax Lbata 1990 And Personal Income Tax Bona Trust Corporation 博纳信托有限公司. Income tax rate Malaysia 2018 vs 2017.

Here are the tax rates for personal income tax in Malaysia for YA 2018. Based on this table there are a few things that youll have to understand. The tax filing deadline for person by 30 April in the following year.

30062022 15072022 for e-filing 6. Deadline To File Income Tax 2019 Malaysia. For further information kindly refer the Return Form RF Program on the.

The tax filing deadline for person by 30 April in the following year. Tax Relief Year 2018. Corporate companies are taxed at the rate of 24.

Income tax return for individual who only received employment income. That said 50 states income ta. Its time to stop making excuses when it comes to finishing your taxes.

The Malaysian tax year runs from January 1st - December 31st. Business income e-B on or before 15 th July Date of online submission may subject to change. Income tax return for individual with business income income other than employment income Deadline.

First of all you have to understand what chargeable income is. Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. Extension of Two Months for Filing Malaysia Income Tax 2020.

The amount of penalty you will have to pay is as per below.

Tax Clock Images Browse 14 847 Stock Photos Vectors And Video Adobe Stock

Itr Filing Latest Breaking News On Itr Filing Photos Videos Breaking Stories And Articles On Itr Filing

Firs Extends The Deadline For Filing 2022 Year Of Asses Kpmg Nigeria

Gst Returns In 2018 Due Dates Requirements And Penalties

Answer Key Objection Latest News Videos Photos About Answer Key Objection The Economic Times Page 1

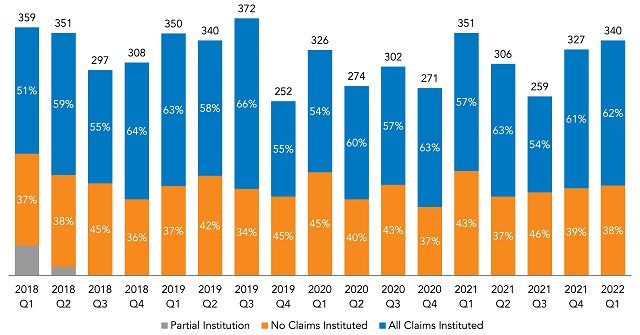

Q1 In Review Courts Tackle Sep Issues As Patent Deals And Third Party Funding Bolster Npe Activity Patent United States

Ouat Admit Card 2018 Download Cee Hall Ticket By Name No Date Medical Test Upsc Civil Services Civil Service Exam

When Are Taxes Due In 2022 Here Are The Major Tax Deadlines You Need To Know Nasdaq

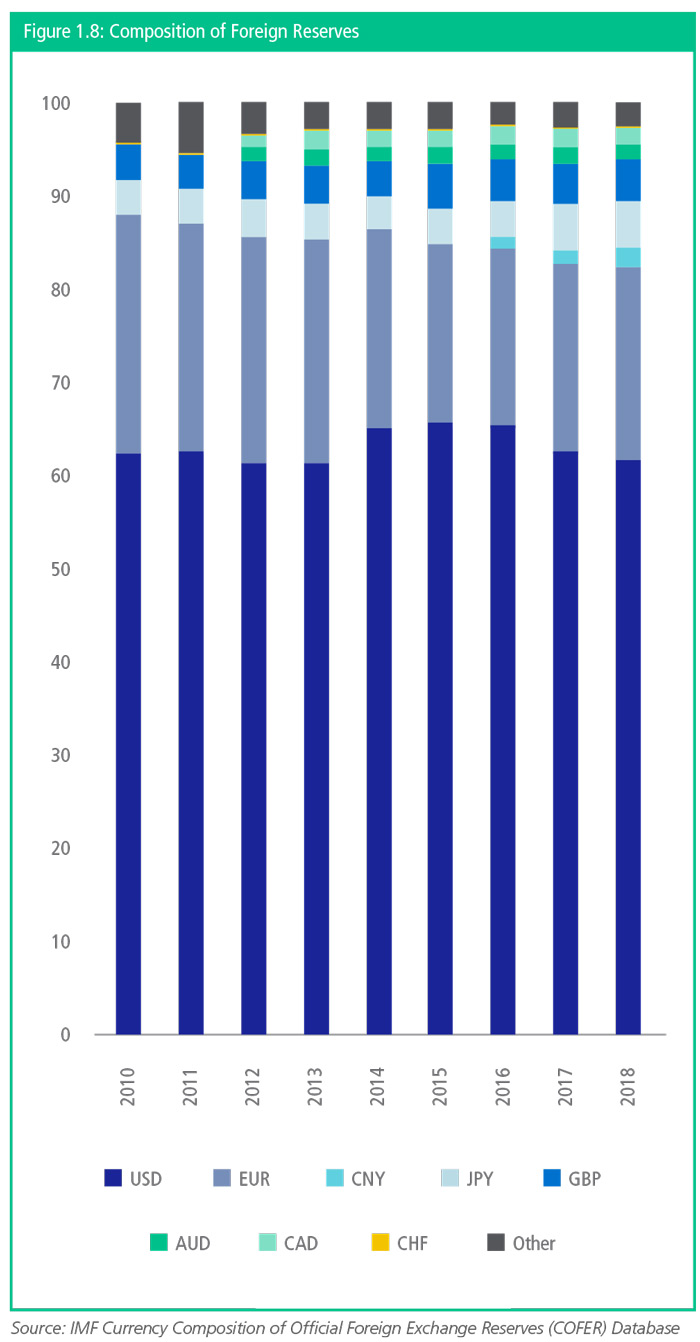

Pecc Chapter 1 Asia Pacific Economic Outlook

A Guide On Remuneration To Llp Partners Income Tax Act Ebizfiling

Tax Clock Images Browse 14 847 Stock Photos Vectors And Video Adobe Stock

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KH4SZPOVAZIN7M3QJ2IU3ULAUA.jpg)

Google Yet To Register For Indonesia S New Licensing Rules Reuters